Insurance Compliance

Services

Comprehensive Insurance Compliance Solutions

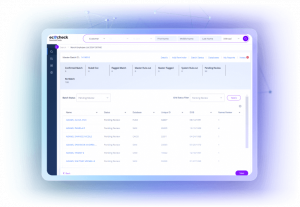

Ensure compliance and minimize risk with ongoing monitoring of exclusions and sanctions, tailored specifically for the insurance sector.

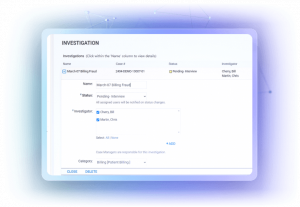

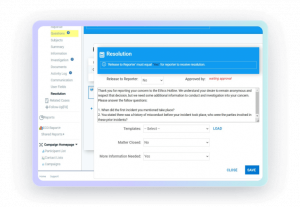

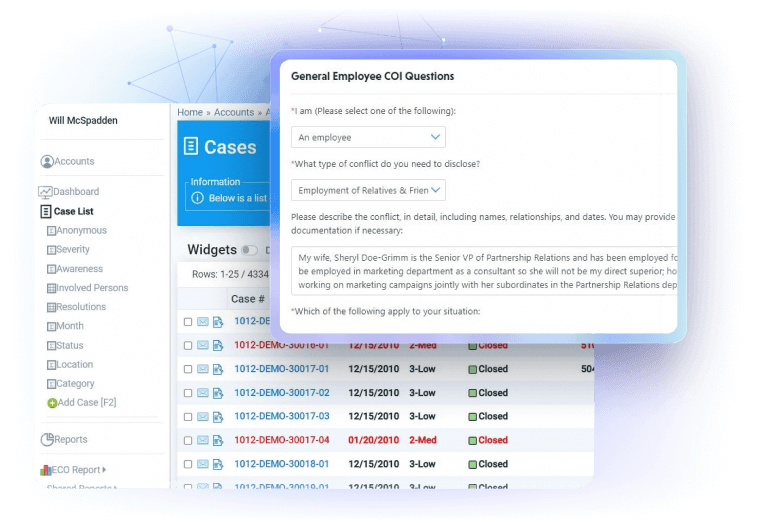

Utilize Ethico’s automated workflows and integrated systems to efficiently manage compliance across all levels of your organization.

Proactively manage potential risks with our advanced analytics and risk assessment tools that keep your operations secure and compliant.

Equip your team with the knowledge they need through custom training programs that address specific regulatory requirements and ethical standards in the insurance industry.

Enhance Insurance Compliance Management with Ethico

Stay ahead of regulatory changes and ensure compliance with precise monitoring tools and compliance reporting.

Leverage Ethico’s automated systems to reduce the time and resources spent on compliance-related administrative tasks.

Build trust with stakeholders by maintaining a transparent and compliant operational framework.

Adapt and scale your compliance efforts seamlessly as your insurance business grows and evolves.

Advanced Compliance Technologies for Insurance

- Robust Data Security

- Comprehensive Vendor Checks

- In-Depth Compliance Audits

- Crisis Management and Response

Secure Your Insurance Operations with Ethico