Social Security Death Master

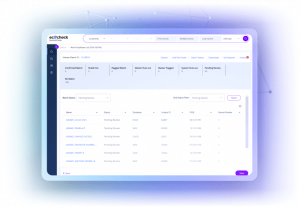

File Search Screening

Comprehensive SSDMF Search Screening Solutions

Automate the verification process against the Social Security Death Master File to prevent the use of invalid or falsified Social Security numbers in your organization.

Seamlessly integrate SSDMF checks into your current screening processes, enhancing your overall exclusion and sanction screening program.

Maintain continuous compliance with regulations through regular checks for new hires, periodic cleanups, and monthly verifications.

Protect your sensitive data with top-notch security and encryption, ensuring that all screenings are conducted safely and confidentially.

Protect Your Organization with Reliable SSDMF Verification

Gain better clarity and reduce risks with precise verification of Social Security numbers, helping to eliminate inaccuracies and fraudulent activities.

Stay compliant with social security and other regulatory standards, minimizing the risk of fines and legal issues with compliant processes.

Streamline your verification processes with SSDMF checks conducted by Ethico’s experienced screening professionals, enhancing productivity and reducing your manual workload.

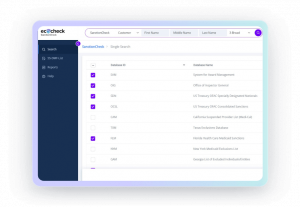

Reduce the likelihood of engaging with unverified or potentially fraudulent entities by ensuring all partners and employees are properly screened.

Advanced SSDMF Search for Enhanced Compliance

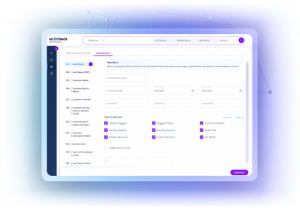

- Secure Data Handling

- Full Regulatory Adherence

- Detailed Audit Trails

- Configurable Screening Options

Expert Responses to Common Inquiries About OIG Exclusion

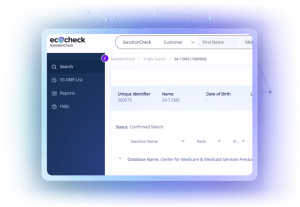

This list is crucial for healthcare providers as hiring someone who is on the LEIE can lead to significant monetary penalties and compliance issues. The OIG updates this exclusion list daily to reflect any changes such as additions or removals, ensuring that healthcare providers have the most current information for their screening processes.

Regular screening helps maintain compliance with healthcare regulations and ensures that new hires or current employees have not been subsequently listed on the LEIE.

Since the LEIE is updated daily with new exclusions and reinstatements, monthly checks help capture any relevant changes that could affect your facility’s compliance status.

While Ethico's competitors give users the ability to loosen controls to lower false positives, they inadvertently open holes that false negatives, sanctioned individuals who are incorrectly cleared, can slip through. SanctionCheck allows false positives to be reduced without increasing the risk of false negatives.

Enhance Your Screening Processes with Ethico