Financial Services

Compliance Solutions

Comprehensive Compliance Tools for Financial Institutions

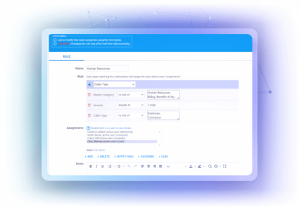

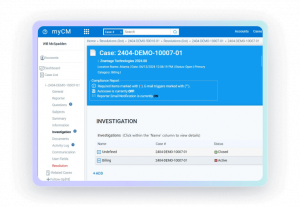

Strengthen your SOX compliance with our comprehensive hotline and case management system, enabling secure reporting and efficient resolution of financial irregularities.

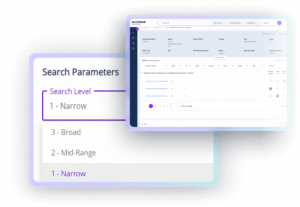

Ensure compliance with OFAC and BSA regulations using our advanced sanction screening solution, designed to identify and mitigate risks promptly.

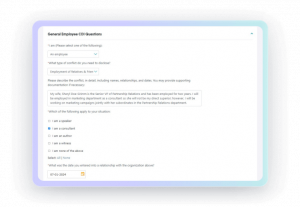

Effectively manage and disclose employee conflicts of interest in line with SOX requirements, maintaining the integrity of your financial reporting.

Stay compliant with FINRA and SEC licensing requirements using our automated tracking system, ensuring your team maintains necessary qualifications.

Enhance your team’s regulatory knowledge and ethical conduct with customized, engaging compliance training programs.

Strengthen Your Financial Governance with Ethico

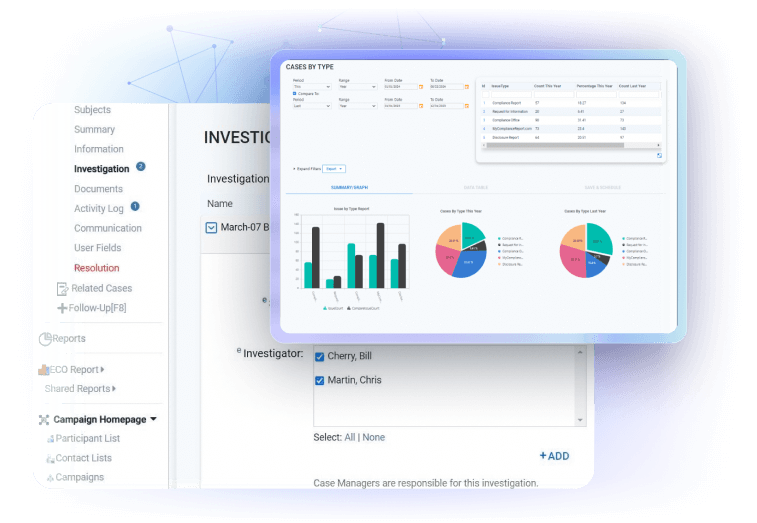

Mitigate risks with our in-depth compliance tools designed to de-hassle your processes, ensuring full adherence to laws and regulations.

Simplify your compliance workflow with automated solutions that reduce manual effort and increase efficiency.

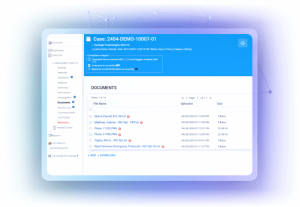

Boost transparency across all compliance operations with our integrated platforms that provide clear audit trails.

Any critical data shared with us is protected with advanced cybersecurity measures integrated into our compliance solutions.

Advanced Compliance Solutions for the Finance Sector

- Simplified Whistleblower Reporting

- Anti-Bribery and Corruption Controls

- Workplace Culture Analysis

- Consumer Protection Compliance

Transform Your Compliance Strategy with Ethico